No products in the cart.

Coffee

RNY Market Watch: Coffee Futures Prices

SEASONS CHANGE, WILL OUR COFFEE FUTURES PRICES?

As we now move into autumn and experience the change of seasons, might it also be time for the markets to experience some changes too? Let’s take a brief look at some of the technical, fundamental and global economic factors. These factors may dictate market movement. and coffee futures prices.

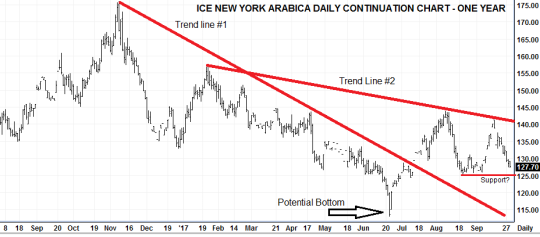

New York Arabica Market

Having broken the formidable down trend line formed since November of 2016, the Arabica market recovered 30 cents per pound. This happened on both fundamental news (lack of available coffee in the mid-summer) and technical factors (a short covering rally where speculators betting on lower prices liquidated large positions after the market found a bottom). There was good support for fall and winter roasting’s between 1.3000 and 1.2500. Therefore, the market seems to have settled down. It might even be poised for a neutral market of range bound prices.

London Robusta Market

Having starred some of the extreme price movement in the chart, one can see that the London price movement has been contracting within a range of roughly 1900 to 2200 since the spring. The tighter ranges indicate that the market (perhaps like what we may see for New York) is moving sideways or more neutral rather than an explicit up or down trend. One last note, on Thursday, June 29th, the London market breached the 200D MA. The last time this market breached the 200DMA to the upside was April of 2016 basis 1550 in the spot month. It crossed back down a year later (April 2017) at 2050.

Momentum indicators (on a daily basis) are approaching oversold conditions at the time of this report.

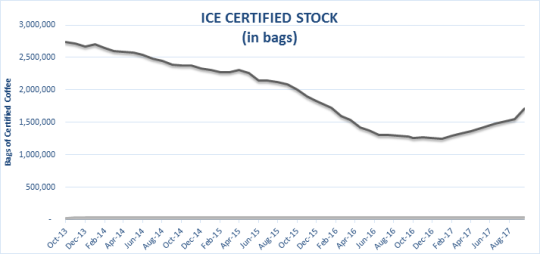

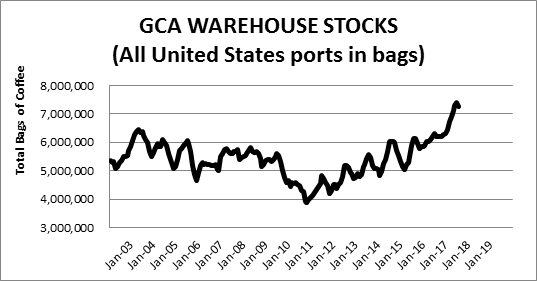

SAME OLD STORY: The certified stock numbers (above) have been building since the lows of end 2016/beginning of 2017. The monthly GCA USA stock numbers (below) continue to show us that exporting countries prefer to destock into consuming countries. Total stocks are at their highest levels since 1994.

Coffee Futures Prices, Macro-Economic Comments:

The Brazilian currency has been flat to higher and one could say on a slow and steady uptrend. With the US Dollar weaker and having made a recent 2 ½ year low, we should see continued stability in the global commodity market in general as the CRB index would prove.

Origin Notes:

Brazil: Brazil differentials have tightened slightly over the past 2 months with the start of new crop. This tightness can be attributed to a consistently low New York C price with producers/exporters holding back on large volume offers with the hope of seeing a market recovery.

Colombians: Differentials remains firm, as there is not much offered currently as producers/exporters wait for the new crop which is just around the corner for October/November. Market prices do not present Colombia a motivation to sell at this time. Producers do speak of potential good yields for this coming crop cycle.

Ethiopia: Ethiopia still has some coffee to sell as we have seen the prices trimmed for lower quality coffees and more so for better quality coffees. New crop picking in some areas will probably start by the middle of November. Stay tuned.

Sumatra: Prices remain firm. In the wake of the recent downturn in the New York C there has

been little if any ease in the internal market price. New crop demand is strong, in addition to the

reduced yields in the remaining Indonesia archipelago causing an overall tight supply.

Robustas: With the focus now off the volatile spot month spread for Sept London, premiums have been tampered a bit and so we watch to see if supply can catch up to demand as we remain in backwardation through Jan of 2018.

Coffee Futures Prices, Conclusion:

The market is forecasting that Brazil will resume a somewhat normal rainfall pattern and with that news we should see roasters participating at the support levels outlined in the charts above. Producers will of course be fixing their supply on rallies and as we get closer to First Notice Day for December which is November 21, 2017.

Once again, this outline is intended to promote thought and an exchange of ideas. If you have an interest to share your point of view, please do not hesitate to contact us.

Something to think about when trading:

One of the hardest things to do is to take less when you think you can get more.

*The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether trading is a suitable investment. We do not guarantee that such information is accurate or complete and it should not be relied upon as such.