No products in the cart.

Coffee

RNY Market Watch: January Coffee Futures Market

What’s to come in 2018 for the coffee futures market? We enter this 2018 calendar year with a record number of non-commercial short positions in the New York coffee futures market. The question that presents itself is, will the market reward those short positions below 12500 – 12000? Or perhaps these short positions need to cover above current market levels?

Let’s analyze some global/macro factors that are not coffee specific:

- The 30-year Bond FUTURE, the bellwether indicator of long term interest rates, lost a full handle as we entered 2018. Lower Bond Futures means higher interest rates, which could be an indication of inflation.

- Another indication of inflation would be Gold futures. Gold futures have quietly gained $50 an ounce over the past 10 trading days.

- Last but not least would be a weaker US Dollar. The USD is approaching the lowest levels it has seen in 2 years. Since the present administration would like to see a more balanced trade deficit, we may see continued weakness in the USD in the future (bullish for commodities).

A bearish US Bond futures market, a bullish Gold market and a weaker US Dollar all indicate potential for a new direction. This change would have a positive influence on commodity prices.

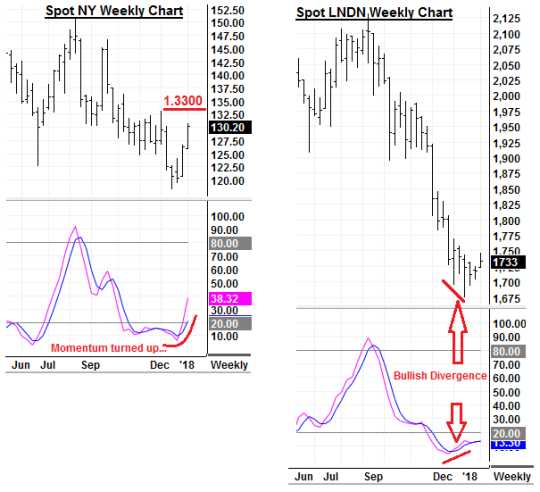

The weekly charts for both New York and London also give us an indication of what we may expect to come.

New York Arabica Market

Looking back at the September RNY Market Watch Report. The formidable down trend line that had formed since November 2016 was broken. The Arabica market recovered 30 cents per pound on both fundamental news and technical factors. Fundamental news was that there was a lack of available coffee in the mid-summer. Technical factors were that there was a short covering rally where speculators betting on lower prices liquidated large positions after the market found a bottom.

I include that passage above as a reminder of what can happen when traders are least suspecting.

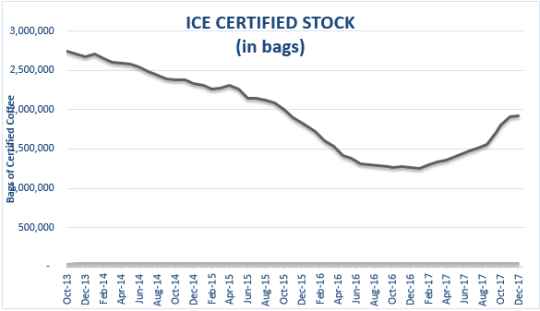

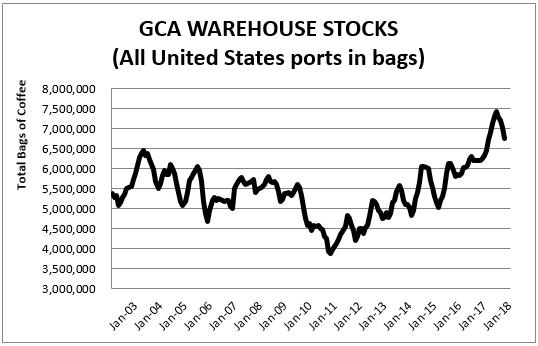

Reference the graphs below of certified stocks at ICE Warehouses along with GCA Stock data. These imply a reduction in the pace of growing stocks at the exchange stores and for non-exchange coffee in particular.

Included in this report are conclusions derived from that observation with the knowledge that the short position of the non-commercial trader is now at a record high for data compiled last Tuesday, and we can expect that the market will be volatile for the near term.

Coffee Origin Notes

Brazil: Brazil differentials have continued to tighten slightly over the past 4 months. This tightness can be attributed to a consistently low New York C price. Producers/exporters have held back on large volume offers. They have the capital to retain inventory with the hope of seeing a market recovery.

Colombians: Differentials remain firm, with more offers coming to the market as producers look to monetize. However, with low futures prices there are not many changes to differentials at this time. This can change, but those changes may not take place until we approach FND March.

Ethiopia: Ethiopia still has 2016/2017 coffees to sell and are offering them at discounted prices over the 2017/2018 prices. New crop picking is still taking place and will probably finish by early February. Offer and pre-shipment samples from 17/18 crop will soon be coming our way to be evaluated. Stay tuned!

Sumatra: Prices continue to remain firm. With the recent lower prices in the New York C there has been little if any ease in the internal market price. New crop demand is strong. The reduced yields due to heavy rains at origin causing a persistent tight supply.

Robustas: No different than the differentials seen with mild coffee origins, robusta differentials have also tightened as the futures market lost 20 cents per pound from their highs this past summer. The backwardization we have seen recently has abated and now the futures board resembles a spot discount, or closer to cash and carry (contango).

What’s next for the coffee futures market

The market has given roasters a chance to extend coverage under 12500. One may read this report and believe that extending coverage with a higher base might be prudent but being patient is another choice. With coffee differentials tighter and the transference of producer inventories to consuming countries, we can expect to see at least some additional short cover of the positions previously mentioned which would give producers a chance to hedge at prices they have not seen since the warm days of summer.

Once again, this outline is intended to promote thought and an exchange of ideas. If you have an interest to share your point of view, please do not hesitate to contact us.

*The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether trading is a suitable investment. We do not guarantee that such information is accurate or complete and it should not be relied upon as such.