Welcome to our latest edition of Market Watch! We’re here to provide you with the latest insight into the “C” market, coffee prices, tariffs, and more as of October 2025.

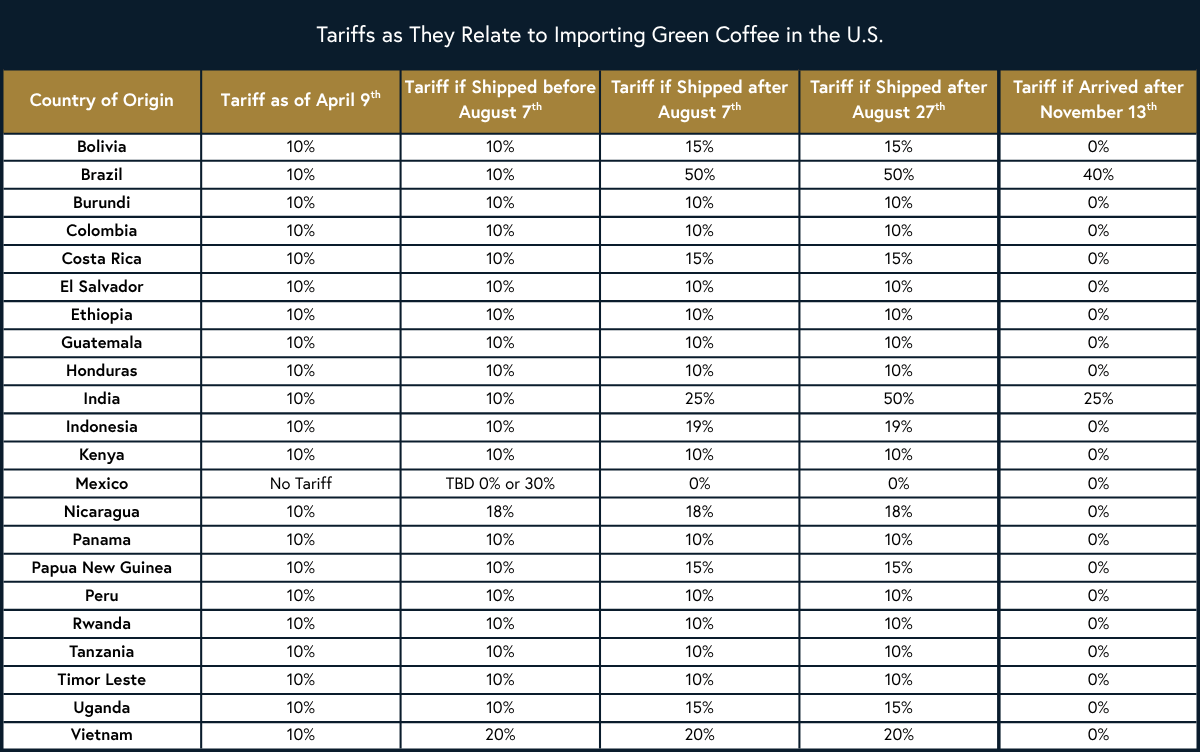

Editor’s Note 11/17/2025: The Trump Administration has rolled back reciprocal tariffs on specific agricultural goods from the majority of coffee-producing countries. Tariffs in relation to green coffee imports have been updated in the chart below.

Volatility & High Coffee Prices

Coffee Futures measured by the NY “C” market continue to challenge our industry with ongoing volatility and high prices. Throughout 2025, the market has set 19 historically high levels with unusually wide daily volatility. Needless to say, we’ve been trading in uncharted waters. With the introduction of tariffs in April’25, the challenges have increased. In the U.S. specifically, there has been a strain on the industry to shift supply channels, rebuild pricing models, issue price increases, and protect shrinking margins. Despite these obstacles, reports say demand hasn’t changed much—a positive sign testifying to the resiliency of our industry.

Currently, there are three primary factors keeping market prices high: concerns for weather in Brazil, tariffs on U.S. coffee imports, and declining certified stocks resulting from the tariffs.

Dry Weather

Brazil’s weather has always been the most impactful variable in the coffee market. Weather concerns started in August as reports came in of higher than usual temperatures, less than adequate rainfall, and reduced soil moisture. Without more rain, there is the possibility of a longer-term concern for 2026 production/supply. However, this is not definitive; there is still time for more rain to come and for soil moisture to improve. Until then, the uncertainty can bolster the market, so we will be watching the forecast in Brazil’s coffee-growing regions carefully.

Coffee Tariffs

In April of 2025, we began paying a “universal” 10% tariff on all coffee-producing countries, except for Mexico. While this was a disruption, the trade absorbed the tariffs, and the market began to settle, reaching a low of $2.73 on July 7th. Later in July, the higher “reciprocal” tariffs were imposed and became active on August 7th, creating an uneven playing field for certain origins, most notably, the 50% tariff on Brazil. This steep tariff on the largest coffee-growing country in the world, fueled by the country’s weather concerns, lifted the Dec’25 contract as high as $4.2500 on September 16th.

Certified Stocks

Certified stocks are reserves of physical coffee that are held by the exchange in “certified” warehouses. Coffee can be tendered to or withdrawn from the exchange, acting as a barometer for global supply. For a point of comparison, think of OPEC for the oil industry. Declining certified stocks signal a tightness in supply, while an increase in stocks indicate the opposite. Due to the disruption in the global flow of coffee from tariffs, certified stocks held primarily in Europe and the U.S. have become a simpler option for larger commercial roasters. This has triggered the drawdown in stocks and provided further support for the market.

While there technically isn’t a global supply deficit, U.S. tariffs have disrupted the usual flow of coffee internationally. This has led to a temporary supply squeeze as importers and roasters are forced to make careful decisions to avoid the more highly-tariffed origins.

Additional Factors Manipulating Coffee Prices

Although these are the primary variables contributing to today’s high market, the “C” market has seen more factors influencing the price than ever before. Speculators have further infiltrated the market, causing large, daily swings, while the coffee trade has primarily watched with uncertainty. Over the past two months, there have been rumblings of a possible coffee exemption from tariffs. However, this is not guaranteed and only adds to the uncertainty of the market. If an exemption or any type of tariff change happens, we will inform our customers immediately.

Going Forward

For us at Royal New York, we’re continuing to push forward while navigating today’s market challenges. We’re actively sourcing coffee from trusted suppliers, working to keep inventory at our usual amounts, and remaining focused on quality. We’re also sourcing coffees and providing guidance on similar profiles to replace or reduce the use of Brazil coffee due to the 50% tariff.

Reserving coffee to establish a fixed price for a period of time is still the best defense for roasters to manage the extreme volatility of the market. Continue to monitor and extend your forward position to ensure consistent supply and price, especially through the holidays. This will allow you to set an increase in your wholesale and retail prices to stabilize your margins. As always, email your trader or give us a call to see how we can help.