From weather disruptions and delayed harvests to tariffs and logistical slowdowns, green coffee origin conditions increasingly shaped pricing, availability, and risk exposure in 2025. What began as isolated challenges quickly turned into a global pattern of tighter supply windows and heightened volatility. As buyers of green coffee, roasters and importers need to understand what’s happening at origin to make informed sourcing decisions in the year ahead. Here’s what factors are influencing 2026 green coffee availability in key origins.

Contributing Factors to 2026 Coffee Origin Arrivals

For green coffee importers and roasters alike, 2025 turned many buying programs upside down. Record high prices in the “C” market, weather concerns in key origins, and the nuisance of tariffs turned what used to be a relatively straightforward booking process into a constant exercise in risk management. Instead of building relationships with producers, dialing in profiles, and planning seasonal menus, many of us spent last year glued to our screens. We looked at the “C” price, refreshed weather reports, and tried to read between the lines of policy announcements to see which origin would tighten next.

While the impact was unclear in the beginning, that quickly changed. There were shorter offer lists, more volatile “C” market exposure, tighter arrival windows, and the uneasy realization that your green program would become heavily shaped by variables far upstream from your roastery door.

Looking Ahead

We’re all hoping for a more stable year ahead, particularly with pricing, now that tariffs no longer affect the market. However, as buyers, it’s important to recognize that improvements don’t happen overnight. Challenges remain, including tight supply, weather-related impacts on yields, and ongoing volatility in the “C” market.

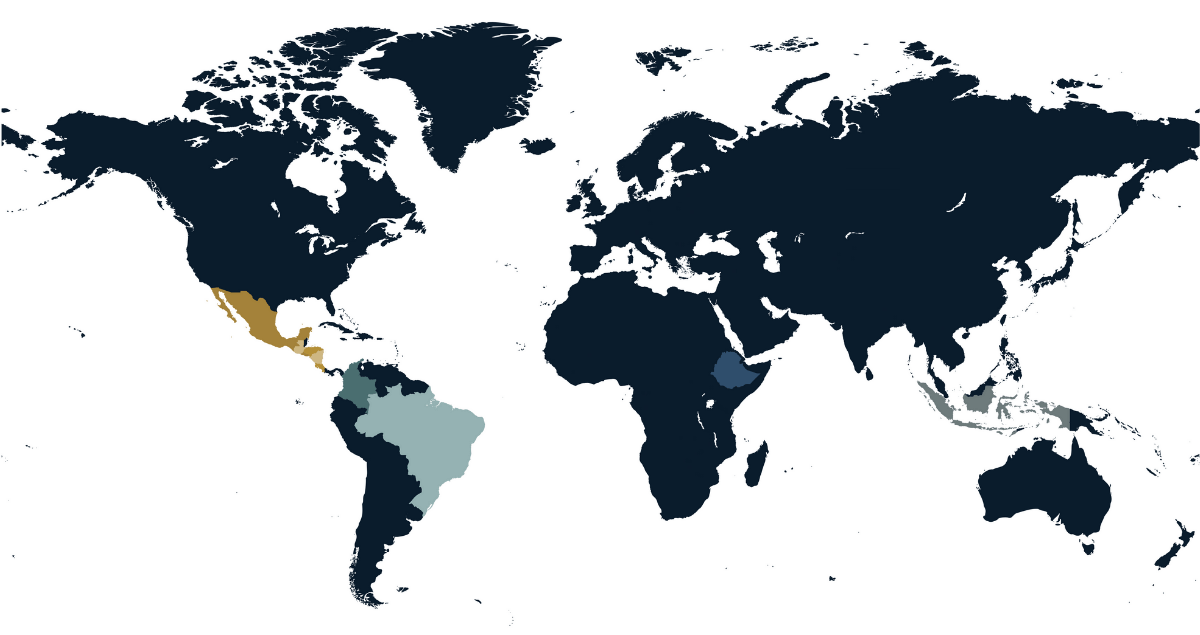

There are a few key areas around the globe that currently warrant our attention. By understanding what’s happening at origin, we can proactively prepare and position ourselves to make informed, strategic decisions.

Green Coffee Arrivals: The Americas

Brazil

In late July 2025, Brazilian coffee exports to the U.S. came to a sudden halt. Tariffs on Brazil imports were raised to 50%, right as early shipments from the new harvest would typically begin. For over three months, millions of bags never reached the U.S., tightening inventories and driving extreme market volatility. Many roasters were forced to delay contracts, source alternative coffees, or adjust blends, just to keep production moving.

Since tariffs were lifted in November 2025, buyers have rushed to re-secure Brazilian supply. Zero-tariff coffees are starting to arrive, but volumes will build gradually.

What does this mean for buyers?

While Brazilian coffee is returning to the market, the disruption has reshaped availability and pricing, making proactive planning and diversified sourcing more important than ever for roasters.

Colombia

Colombian coffee production is expected to ease slightly from recent highs due to heavy rainfall that has disrupted flowering and slowed harvests in key regions. While overall volumes remain strong, uneven harvest timing is creating pockets of inconsistent availability. Farmgate and export prices have maintained elevated levels, supported by strong global demand and rising costs.

What does this mean for buyers?

Export volumes may be slightly lower, which could impact spot availability and lead times. Securing coverage early and maintaining flexibility will be essential to navigating the market this season.

Central America & Mexico

Across Central America and Mexico, coffee harvests are facing delays and uneven flows due to drought, heavy rains, and tropical storms, slowing flowering and cherry maturation. Labor shortages and rising wages in Honduras and Guatemala, along with lower production forecasts in Costa Rica, Nicaragua, and Mexico, are pushing costs higher and tightening local availability. Lastly, El Salvador’s 2025–26 coffee harvest is expected to recover modestly in volume after weather-related losses the prior year. Conditions remain challenging at the farm level as labor shortages, higher input costs, and aging coffee farms still persist.

What does this mean for buyers?

Early planning and securing coverage is critical as supply windows are shifting and prices remain firm. Flexible sourcing strategies and strong communication with importers will help ensure consistent delivery for blends and single-origin programs this season.

Green Coffee Arrivals: Africa

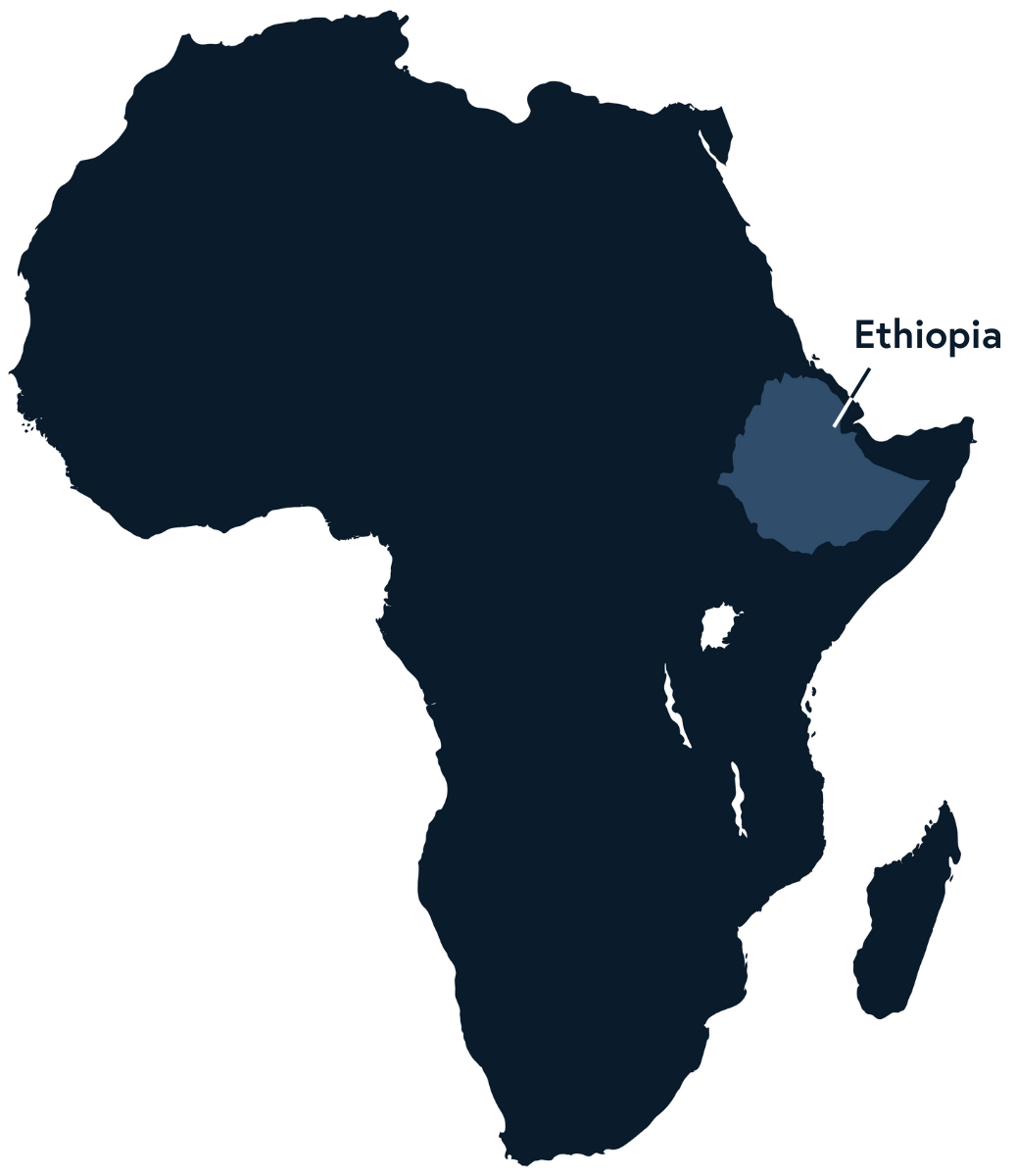

Ethiopia

The upcoming Ethiopian coffee harvest is shaping up to be a complex season for buyers. While overall green coffee production volumes remain strong, a later-than-normal start to harvest and increased competition for cherry at origin are pushing costs higher and making timing more critical.

Across several coffee-growing regions, the 2025/26 harvest began later than usual due to irregular and delayed rainfall, which disrupted flowering and slowed cherry development. Rather than a uniform start, many areas are seeing uneven ripening and staggered harvest timelines.

What does this mean for buyers?

Green coffee is unlikely to arrive all at once from origin. Early season availability may be limited, with peak volumes spreading later into the harvest. High-elevation and specialty lots may take longer to prepare for export, which will require greater flexibility in planning. While these delays are not expected to significantly reduce total production, they do impact timing, cash flow, and logistics, making early communication and planning essential this season.

Green Coffee Arrivals: Indonesia

Sumatra

Recently, Cyclone Senyar brought heavy rains, flooding, and landslides to Aceh and North Sumatra, damaging coffee farms and disrupting access to key coffee-growing areas. The effects of the cyclone are expected to delay exports and tighten supply, with industry sources projecting a noticeable drop in available arabica from the region this season. Farm-level damage and interrupted processing may also cause inconsistencies in quality, putting upward pressure on pricing.

What does this mean for buyers?

This means slower arrivals and higher costs for Sumatra coffees. Securing contracts early and maintaining close communication with your importers will be essential to protect blends and ensure consistent supply throughout these challenging conditions.

Final Thoughts

Global coffee markets continue to face volatility amid continued disruptions. Everything from weather events to delayed exports fuel ongoing price volatility. For roasters, this underscores the importance of securing green coffee early and often. Building strong relationships with trusted suppliers and locking in contracts ahead of time can help protect both blends and budgets. In a market this unpredictable, proactive planning is key to maintaining consistent supply and avoiding last-minute challenges. Staying ahead now will pay off when the market stabilizes.